Electricity and natural gas provide heat, power and light to homes and businesses. Water heaters, clothes dryers, grills, furnaces and gas ovens are among the appliances using natural gas. Meanwhile, refrigerators, dishwashers, electric ovens, TVs and much more run on electricity. Needless to say, people need their electricity and natural gas!

In 20 states, the utility markets are fully regulated. The natural gas and electric utilities owns and operates everything involved, from A to Z. The rest of the states and the District of Columbia have deregulated markets for electric or natural gas, or both.

In deregulated markets, consumers can choose their electric or natural gas provider. However, deregulation is not always statewide. For example, many markets in a state may be open to choice, but consumers in rural areas may have no option but to go with their local utility.

This guide offers statistics on deregulated utilities and explains how to choose if you’re in a deregulated market. It also discusses what to know about your state if it is deregulated.

Table of Contents

Facts and Statistics about the Private Utilities Market

What are deregulated utilities?

Utility deregulation can be confusing, so think about shopping for apples in a grocery store. An apple grower sells apples directly to stores, and stores set their own prices for customers like you. A deregulated utilities market is similar; you buy electricity from a provider (retailer) instead of from the utility. Table 1 explains in more detail, using electricity as the example. The principles for natural gas are comparable.

One important thing to know: In virtually all deregulated markets, consumers still have the option to stick with their local utility for everything (and many do!).

Table 1: Regulated vs. Deregulated Electricity Markets

- The utility has complete, vertically integrated control from beginning to end. It controls electricity generation all the way down to the customer’s meter.

- Just one or two utility companies in the market offer electricity. Customers’ choices are limited, but state utilities commissions oversee rates to ensure they are fair.

- Utilities don’t require customers to sign contracts.

- The process is more streamlined because fewer players are involved.

- Various companies invest in power plants, solar energy, wind farms, electricity generation and transmission lines.

- Wholesale retail suppliers buy the electricity generated.

- These suppliers (also called retail energy providers, or REPs) set prices for customers and bill them.

- In some markets, the utility and the REP bill separately instead of on one invoice.

- Customer choice applies only to the generation portion of the bill. The utility remains responsible for many functions, including restoring power during outages and reading customers’ meters.

- The utility offers standard service rates for customers who do not want to choose a third-party provider.

- The market is competitive, with more incentive for energy companies to explore greener sources. Customers have the freedom to shop based on their budget and clean energy preferences.

- REPs can offer incentives such as gift cards and discounts to get customers to sign up. Even door-to-door marketing is usually allowed. However, all this marketing sometimes misleads or overwhelms customers. Some have a hard time identifying good deals and unwittingly overspend.

- REPs generally require contracts for fixed rates, the most popular rate type. Contracts usually aren’t required for variable rates.

- Customers not under contract can switch providers at any time, and there won’t be service interruptions.

- Customers receive the same electricity, regardless of their provider.

Good terms to know include these:1

- Generation: Process of converting energy into electricity. Energy sources include coal, oil, natural gas, fission, solar, wind and hydroelectric.

- Transmission: The transporting of electricity, often over long distances, from power plants to communities.

- Distribution: The transference of electricity from transmission cables into a customer’s home or business.

- Natural monopoly: When only one party is able to provide a service due to high fixed costs. Transmission and distribution are natural monopolies for electrical utilities, even in deregulated markets.

Deregulated Electricity Markets

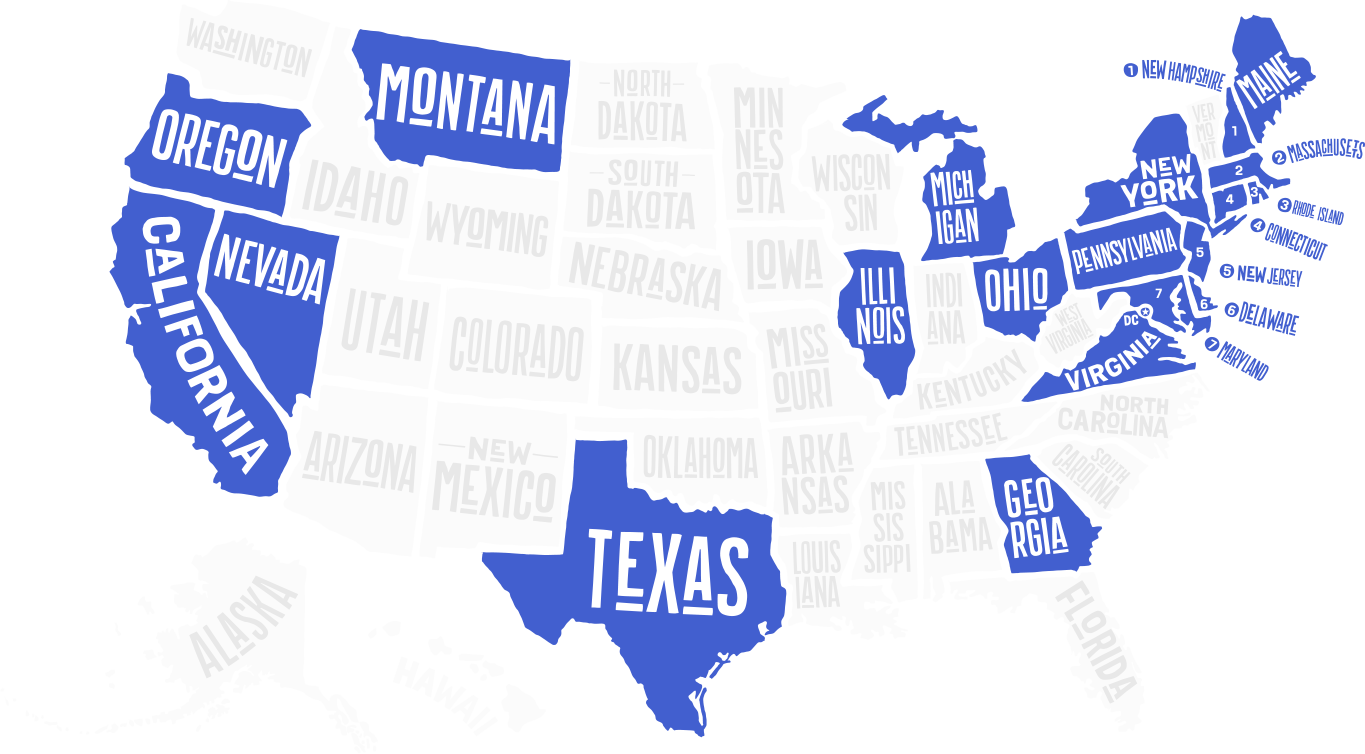

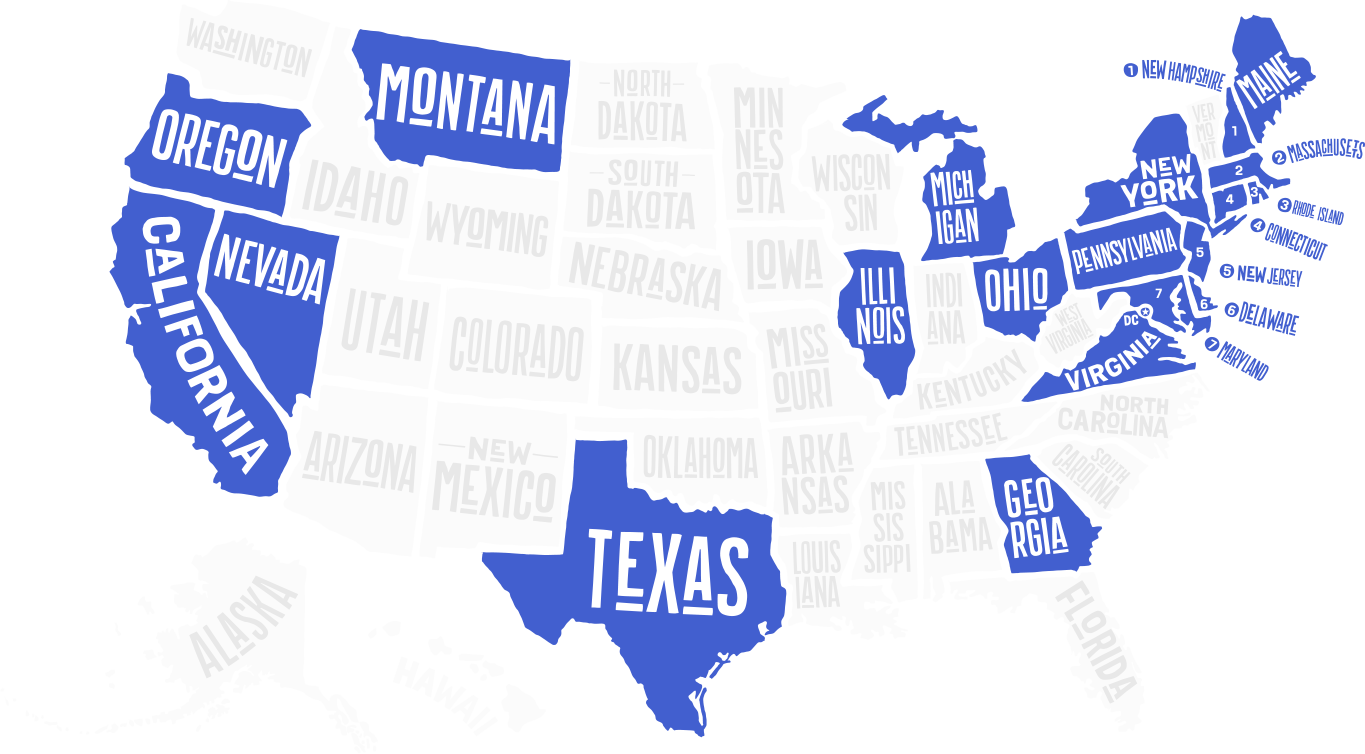

20 states and the District of Columbia have electricity markets that are at least partially deregulated.2

- 1. California

- 2. Connecticut

- 3. Delaware

- 4. District of Columbia

- 5. Georgia

- 6. Illinois

- 7. Maine

- 8. Maryland

- 9. Massachusetts

- 10. Michigan

- 11. Montana

- 12. Nevada

- 13. New Hampshire

- 14. New Jersey

- 15. New York

- 16. Ohio

- 17. Oregon

- 18. Pennsylvania

- 19. Rhode Island

- 20. Texas

- 21. Virginia

In states such as Georgia, Michigan, Nevada, Oregon and Virginia, choice is limited to non-residential consumers. In California, residential consumers cannot directly choose either, but community choice aggregation is popular. It allows for some choice and monetary savings (more on this soon).

Deregulation has not really decreased prices

- Electricity prices are noticeably higher in states with deregulated markets—but there’s a good reason for that. These states grappled with higher prices in the first place, which is why they wanted to deregulate. 3

- Factors such as fracking, post-9/11 oil price spikes, ongoing Middle East conflicts and turmoil in Venezuela have affected electricity prices more than regulation and deregulation.3

- The retail price difference between regulated and deregulated markets has stayed about the same. For example, in 1997, average revenue in deregulated states was 8.1 cents per kilowatt hour versus 5.8 in regulated states (a difference of 2.3). In 2017, it was 11.8 in deregulated states and 9.6 in regulated states (a difference of 2.2).4

Residential Customers stick with the default electric utility

- Participation in residential customer choice programs has remained virtually the same since 2013. In 2014, the number of consumers choosing a third-party provider peaked at 17.2 million (about 13% of residential customers). In 2017, the number had declined to 16.7 million (still about 13% of residential customers). Even at the peak of choice, not many people were up for it.5

- The Electric Reliability Council of Texas (ERCOT) covers about 87% of the state’s residential customers. They must choose a third-party electricity provider or be assigned one. In all, about 58% of Texas residential customers choose their electricity provider.5

- In other states, the percentage of customers choosing is much lower (since these other states have voluntary choice programs). Ohio comes closest, with 46% of customers choosing third-party providers. Third is Massachusetts, at 39%. In Delaware, just 6% of consumers choose.7

Residential customers save money with the default utility

- Residential customers pay more with choice (but commercial and industrial customers save money). For example, residential customers in New York pay 2.3 cents more per kilowatt hour compared with the default utility rate. Customers in New Hampshire and New Jersey pay 1.5 cents more per kWh. In Michigan, the comparison is nearly equal, with third-party customers paying just 0.1 cents more per kWh. 6

- Local utilities offer inexpensive rates because they are legally required to follow procedures such as buying energy from the lowest bidders. It can be tricky for retail providers to offer lower prices.

- Sometimes, residential customers are happy to pay more money for renewable energy. Other times, they may not realize they are overpaying.

Community choice aggregation

California

Many residential consumers in California benefit from the state’s partially deregulated market, thanks to community choice aggregation (CCA). Local governments aggregate the electric load of a community, buying electricity in bulk at wholesale prices. They charge low rates to residential consumers while focusing on sustainable energy. The “choice” part of the term, “community choice aggregation,” refers to the fact that CCAs choose the types of energy in their portfolios (renewable, coal, natural gas, etc.).

- The first CCA in California was founded in 2010 in Marin County. About 8,000 customers enrolled, liking the CCA’s focus on greener power. Just eight years later in 2018, the Marin Clean Energy CCA served four counties and about 470,000 customers.7

- CCAs usually offer three programs to customers: a default program, a solar-focused program and a more expensive program emphasizing 100% renewable energy sources.7

- The focus on green energy has only grown. For example, the net metering program gives homeowners incentives to use rooftop solar power.8

- As of May 2020, the state had 21 CCAs.9

- About 10 million customers in California are served by community choice energy providers. That translates to more than 170 cities, towns and counties.10

Nationwide

- CCAs are legal in nine states: California, Illinois, Massachusetts, New Hampshire, New Jersey, New York, Ohio, Rhode Island and Virginia. However, no groups in Virginia and New Hampshire have ever formed programs. Five additional states are investigating whether to make CCAs legal.11

- Massachusetts is home to the nation’s first CCA legislation, signed in 1997. In the Bay State, CCAs are called MEAs, or municipal energy aggregators. Massachusetts is also home to the oldest MEA/CCA in the United States. The Cape Light Compact was founded in 1997.12

- About 150 of the 351 municipalities in Massachusetts participate in some type of MEA.13

- Most CCA programs have default enrollment, and residents must take deliberate steps to opt out of them. Otherwise, the groups might not have enough enrollees to reach critical mass.14

- Opt-out percentages average about 5% to 15%.14

- In 2017, about 100 of the 750 CCAs nationwide went above and beyond state-required minimums for renewable energy. Wind energy was big, accounting for about 78% of these voluntary sales. 14

Natural Gas Deregulation

23 states and the District of Columbia have deregulated natural gas markets.15

- 1. California

- 2. Connecticut

- 3. Delaware

- 4. District of Columbia

- 5. Georgia

- 6. Indiana

- 7. Kansas

- 8. Maryland

- 9. Massachusetts

- 10. Maine

- 11. Michigan

- 12. Montana

- 13. Nebraska

- 14. Nevada

- 15. New Hampshire

- 16. New Jersey

- 17. New York

- 18. Ohio

- 19. Pennsylvania

- 20. Rhode Island

- 21. South Dakota

- 22. Wisconsin

- 23. Wyoming

- 24. Virginia

Like with electricity, natural gas consumers are not crazy for choice. For example, of the 10,670,636 eligible consumers in California, only 462,258 participate in choice.16

Nationwide, about 40,297,104 consumers are eligible for natural gas choice, but a mere 6,801,086 participate. 16

The five states with the most participants are Ohio, Georgia, New York, California and Pennsylvania. 16

Beware of Scammers

- Scammers proliferate in many customer choice markets. Groups such as the Pennsylvania Utility Commission must navigate the fine line between choice and shady marketing. In 2020, the commission proposed a $8.8 million fine against Texas-based Verde Energy for more than 8,000 alleged violations. The commission wants to revoke Verde Energy’s license to do business in Pennsylvania.17

- The National Grid utility, which operates in several states, is just one of many utilities cautioning consumers about phone and email scams.18

Has customer choice been good for economics?

- Customer choice has been a mixed bag economy-wise. For example, California got off to a disastrous start with electricity deregulation, a big reason its markets are only partially deregulated today. The 2000-2001 electricity crisis resulted in blackouts, unethical financial manipulations, energy company collapses and state government bailouts.

- As touched on earlier, customers don’t really save money through choice, and many stick with the default utility. It’s hard for third parties to offer lower rates, but they can compete on clean energy.

- Deregulation does seem to have been good for renewable energy. Utilities must obtain state approval before they invest in new projects. These projects must show clear returns—not always easy to do, so utility investment in the future is tricky. Having third parties in the market allows for more investment and green energy innovation.

- Costly taxpayer-backed utility projects such as Georgia’s Plant Vogtle nuclear construction do still get approved, much to the horror of some officials.19

- Residents and clean energy investors in many states are concerned about governments looking backward instead of forward. Private investors worry that the markets will favor the longtime utilities and treat third parties unfairly. These concerns are not good for economies in the big picture since hesitant investors mean less participation and innovation.20

How to Choose a Provider If You Are in a Deregulated Market

In a deregulated market, you can choose your electric or natural gas provider—or even both. There are several ways to go about it, but your best bet may be to stick with your utility’s standard service offer. Consider issues such as these:

- How much money do I have for these bills?

- How comfortable am I with risk and contracts?

- How much research am I willing to do?

- Is there a tool such as PAPowerSwitch or PAGasSwitch to help me compare rates?

- Are direct and/or aggregation options available?

- How important is clean energy to me? Am I willing to pay higher bills for it?

- Am I enrolling for the first time, or do I have an existing relationship with a utility or provider?

Let’s look at each bullet point one by one.

Amount of money you have for utility bills: If you’re like most people, you don’t have a ton of money and want the lowest rates possible. Take a long, hard look at your utility’s standard service offer—it’s the best deal in many places. Customers get a fixed rate, can cancel at any time and don’t need to worry about contracts. Aggregation is another good option to consider if you’re eligible.

Comfort level with risk and contracts: Choosing a third-party provider may come with some risk. Common pricing structures include fixed, variable, indexed (market), and prepaid. Go with fixed rates or prepaid plans to lower your risk.

| Rate Type and Overview | Good for | Advantages | Disadvantages |

|---|---|---|---|

|

Fixed: Your rate per kilowatt hour is locked in for a specific length of time. Fixed plans are popular due to the certainty they offer. |

|

|

|

|

Variable: Rates vary month to month depending on the wholesale price of electricity or natural gas. You could consume the same amount of product each month yet pay vastly different rates. |

|

|

|

|

Indexed (Market): Your rates are tied to time of use or a publicly available index such as the cost of electricity for the month. Rates can be variable or fixed, so check your contract. |

|

|

|

|

Prepaid (Pay As You Go): You pay a certain amount of money and receive electricity or natural gas. Balance refills are allowed. Fixed and variable plans are available, although variable-rate plans are more common. |

|

|

|

Let’s talk contracts. They’re common with fixed-rate plans and often come in six-month increments. You could lock in a fixed rate for, say, six months or two years, sometimes even three or four years. If you move out of the service area and must therefore break your contract, penalties usually don’t apply. If you’re moving within the same service area, the contract is likely to still apply. You typically get hooked up at your new address with no penalty.

Keep timing in mind when you sign a contract. Suppose you lock a fixed electricity rate in, say, January, for six months. The contract is set to expire right before August, a hot month in Texas. Your new fixed rate will be higher since it’s summer (and variable rates are higher, too). In this situation, it may be better to sign a one-year contract instead of a six-month contract.

Amount of research you’re willing to do: Choosing a provider can get complicated really fast. No worries if you would rather not spend hours on research. It’s perfectly fine to stick with your local utility’s standard offer or your aggregator’s offer. It’s the cheapest rate in many areas (or close to it).

Rate comparison tools: States such as Pennsylvania and Texas use handy rate comparison tools to make it easier to research the different providers, plans and rates. To see if your state has such a tool, look your state up in the state-by-state information section in this guide.

Otherwise, you may need to evaluate offers one by one on providers’ websites. Your local utility can give you provider lists if you call, and they’re often on utilities’ websites. Likewise, many state regulatory authority websites have provider lists.

Direct choice and/or aggregation: You might have direct choice and the choice of going with an aggregator—plus the option of the utility’s standard service rate.

In aggregation situations, a municipality (or group of municipalities) purchases electricity in bulk. You pay fixed rates that are often equivalent to or lower than prices you would get from the utility. For example, take the Westport (Massachusetts) Electricity Program. Enrollment is automatic, so you must opt out if you don’t want to be in the aggregator program.

For the 36 months from September 2018 to January 2021, you would pay $0.10430/kWh for supply services under aggregation compared with $0.12517/kWh if you signed up with the Eversource utility for basic service. Clear aggregation savings there. However, the National Grid utility offers basic service rates of $0.09898/kWh—lower than the aggregation rate.

A disclaimer states, “A goal of the CEA program is to produce savings for customers, but savings cannot be guaranteed compared to the utility’s basic service rate which changes every six months. … The aggregation program seeks to provide price stability and average savings over the full term of the program, but because future basic service rates are not known, there is no guarantee of savings.”

Last but not least, you can compare many direct choice offers through the Energy Switch Massachusetts website.

Importance of clean energy: If you are willing to pay higher bills for clean energy, you might prefer plans offering, say, 100% renewable energy versus 0% or the state’s required minimum. Plans in your area may also include options for wind, solar and other types of clean energy.

If your community has an aggregation program, research the program. Many CCAs have a basic energy option and then one or two choices focusing more on clean energy.

You won’t necessarily pay more for renewable energy plans. However, sometimes clean energy does mean higher bills.

First-time enrollment or existing relationship: If you just moved into the service area, there are no pre-existing contracts to worry about. If you have existing relationships or contracts, early termination fees may apply if you switch providers.

One more thing: Ask your providers questions before you sign up for a plan. Many states offer tip sheets such as this one for Michigan natural gas. Questions to ask include:

- What’s the rate charged?

- Is it fixed or variable?

- Are there cancellation penalties?

- What happens when the contract ends? Does it continue, and how do I learn about price changes?

State-by-State Things to Know (for Each State That Is Deregulated)

California

Electric and Natural Gas

California’s electricity markets are partially deregulated, open only to a capped percentage of commercial and industrial consumers in the Pacific Gas and Electric, San Diego Gas and Electric, and Southern California Edison territories. The program is called “Direct Access.”

However, many residential customers use customer choice aggregation, or CCA, to save money and invest in renewable energy. CCAs buy electricity at wholesale prices, enabling communities to aggregate their electric load and pursue clean energy projects.

CCAs are the default provider for customers in their service areas, and opt-out rates are low. For instance, just 2.4% of Clean Power SF customers opt out, and 2.5% of Peninsula Clean Energy customers do.

As for natural gas, residential and commercial customers in Pacific Gas and Electric, San Diego Gas and Electric, and Southern California Gas (SoCalGas) territories get direct choice through the state’s “Core Aggregation” or “Core Transportation” program. As the PG&E website explains:

“At PG&E, you can continue to get your gas from us or you can sign up for an optional service known as Core Gas Aggregation Service (CGAS). CGAS allows you to purchase gas for your home or business directly from third-party gas suppliers known as Core Transport Agents (CTAs). Customers are not required to sign up with a CTA and can continue to receive natural gas from PG&E—it’s your choice.

PG&E will continue to transport and deliver gas to your home or business with the same high level of safety, reliability and service that we provide to all of our customers regardless of which gas supplier you choose.”

Connecticut

Electric and Natural Gas

Residential customers in Connecticut are not allowed to pick their natural gas provider, but commercial customers can. For electricity, residential and non-residential users in the Eversource and United Illuminating (UI) territories can pick their supplier.

Energize Connecticut is a website to help shoppers compare electricity rates and other cost considerations. You choose your utility territory and account type to review offers. As with similar tools from other states, the results can be overwhelming. For instance, if you choose Eversource and a home account (as opposed to business), more than 70 offers result. You can further customize by pricing (fixed, fixed-tiered or all), fees, special terms, term of offer (from four billing cycles to more than 36, or all terms), renewable energy and maximum rate.

This second round of results can still overwhelm, but fortunately, the chart is fairly easy to read. It even shows how much you save (or pay more) compared with the utility’s standard offer.

If your goal is to save money, consider sticking with the utility’s standard offer, or do enough research to be sure your alternative provider charges less. A report from the Office of Consumer Counsel indicated that, in August 2019, eight out of 10 customers who got electricity from a retail supplier paid more than Eversource’s standard offer. In UI territory, the number of customers paying more climbed to nine out of 10.

The Connecticut Public Utilities Regulatory Authority (PURA) approved new rules in May 2020 to make alternative suppliers’ marketing efforts more transparent. Among other things, door-to-door visits and phone calls lasting more than 30 seconds must be recorded, with these records kept for at least three years. Suppliers must start following the changes by August 6, 2020, and the state has about 50 alternative electricity suppliers.

Community choice aggregation is not allowed in Connecticut, but efforts to implement it grow stronger every year. Some legislators are in no hurry for it to happen. They fear that Connecticut aggregators will end up overpaying for electricity like so many individual consumers do.

In 2019, nearly 40 churches and nonprofits got a head start on aggregation, signing a contract that saved them about $50,000 altogether. In 2020, more than 70 groups signed the contract.

Delaware

Electric and Natural Gas

In Delaware, residential consumers do not have natural gas choice, although transportation choice is allowed in the Chesapeake and Delmarva territories for large commercial and industrial users.

Meanwhile, electricity choice is available for residential and non-residential consumers in the Delmarva territory and in the Delaware Electric Cooperative. The state has offered electric choice since 1999.

District of Columbia

Electric and Natural Gas

The natural gas utility Washington Gas Light provides service to the entire district, and consumers can choose an alternative provider. Similarly, Pepco is the electric utility, and consumers can pick another provider. The District’s public service commission has information on choosing suppliers, with calculators included. Aggregation is available, as well.

Georgia

Electric and Natural Gas

Only commercial and industrial companies qualify for electric choice in Georgia. As for natural gas, choice is available for both residential and non-residential users in AGL territory. The state’s Public Service Commission website lists available marketers (also called suppliers or providers). A few of them serve just commercial customers. To get an idea of the plan options, check out the rates at Gas South and Georgia Natural Gas (there’s a senior discount plan!).

Florida

Natural Gas

Residential consumers in the Central Florida Gas/Florida Public Utilities territory can choose third-party suppliers, although the process is unorthodox. When consumers initially begin service, they are assigned to an approved supplier. If consumers prefer another supplier, they need to get in touch with Central Florida Gas to request the change. The state used to have an enrollment period lasting just two weeks, but that has been scrapped.

Commercial and industrial customers statewide have the option of choosing their provider, but each utility has varying volume requirements.

Kansas

Natural Gas

Customers in the Kansas Gas Service territory can choose third-party suppliers but only if they consume 800 to 1500 MCF of natural gas a year. This is a large amount suited for bigger consumers (more details below in Kentucky, where 120 MCF is the average residential usage per year).

Kentucky

Natural Gas

Residential and small commercial operations in the Columbia Gas territory can choose their natural gas supplier. As the Columbia Gas Customer Choice website explains, “The prices charged by suppliers are set by a competitive market, meaning there is no guarantee that you’ll save money, but they may offer special pricing and incentives.”

The Kentucky Public Service Commission has a comparison chart showing marketer offers and price options. The chart uses 120 MCF as its average residential usage per year (with 14 to 17 MCF during each winter month).

Illinois

Electric and Natural Gas

There’s a lot of choice happening in the Prairie State. For instance, residential and non-residential consumers in the Ameren and ComEd areas qualify for electric choice. The “Plug In Illinois” website isn’t the most helpful (certainly nothing like the Texas comparison tool). Rates are difficult to compare, but the website does give a list of suppliers and explains useful information such as real-time pricing. Through real-time pricing, consumers can determine the best time of day to use their appliances for monetary savings.

There are also municipal aggregation programs, and residents can opt out. As the Citizens Utility Board explains, the most inexpensive option tends to be the utility’s supply price.

For natural gas, residential and non-residential consumers in the Nicor, North Shore and Peoples Gas territories can choose their supplier. If you’re a commercial or industrial customer in the Ameren territory, you can pick your natural gas supplier as well. The Citizens Utility Board also has helpful information for natural gas selection.

Indiana

Natural Gas

In the NIPSCO utility territory, both residential and non-residential customers have natural gas choice. As a fact sheet points out, “Enrolling in Choice may or may not save you money.” Enrollment is available year-round, and a calculator on the NIPSCO website helps figure out your potential savings.

As of 2020, 20 alternative suppliers participate in the program and are allowed to market their offerings, including through door-to-door contact. To enroll with one of these suppliers, contact the supplier through phone, fax, email or in person. It’s important to remember that participation truly is voluntary, no matter what any marketing efforts may make you think.

Maine

Electric and Natural Gas

In Maine, only commercial and industrial customers get to choose their natural gas supplier. However, residential and non-residential customers in the Versant (formerly Emera) and Central Maine Power territories can pick their electricity supplier.

The Maine Office of the Public Advocate has information for customers choosing. For example, the office explains that an alternative supplier saves you money only if the price is lower than the utility’s standard offer. The Maine Public Utilities Commission maintains a list of suppliers.

Maryland

Electric and Natural Gas

Natural gas consumers in the Baltimore Gas and Electric Company (BGE) and Washington Gas Light (WGL) territories can choose their providers. Electricity choice is available in the Baltimore Gas and Electric, Choptank Electric Cooperative, Delmarva Power and Light, Potomac Edison, Potomac Electric Power Company (Pepco) and SMECO territories.

Residential electricity shoppers can use the MD Electric Choice website to aid their decision. Commercial and industrial consumers use a different website.

Massachusetts

Electric and Natural Gas

Both residential and non-residential consumers can choose their electricity supplier in the Eversource, Fitchburg Gas and Electric, and National Grid territories. The Energy Switch Massachusetts website helps consumers compare rates. It’s pretty easy to use, although the number of plans to compare can be overwhelming (as usual). Aggregation is legal, and many Massachusetts towns and cities use it. The state keeps a list of all approved municipal aggregations.

Natural gas choice is available in parts of Massachusetts, for example, if you are in Eversource or Unitil territories. Participation varies, so check with your local utility about whether you can choose.

Michigan

Electric and Natural Gas

Michigan’s electricity setup is frustrating, and choice is limited. That’s because of a state law saying that, “no more than 10% of an electric utility's average weather adjusted retail sales for the preceding calendar year may take service from an alternative electric supplier at any time.” The Mackinac Center for Public Policy indicates that more than 7,000 customers are waiting to choose their provider and that 28% of customers would use a different provider if there were no cap.

Michigan did have true electric choice from 2000 to 2008. After 2008, when the law was amended, consumers started paying more than they did under free choice, and the state has the dubious honor of consistently ranking in the top five states for most power outages.

As for natural gas, residential and non-residential consumers in the Consumers Energy Company, DTE Gas Company, Michigan Gas Utilities and SEMCO Energy Gas Company territories have choice. Currently, more than 365,000 Michiganders use an alternative gas supplier, according to the state. Use the “Compare MI Gas” website to assess suppliers. There’s also a tip sheet with things to know and questions to ask.

Montana

Natural Gas

Residential and commercial consumers in the NorthWestern Energy and Energy West Montana territories can choose providers, which include Big Sky Gas.

Nebraska

Natural Gas

Nebraska’s Choice Gas program is available to residential, agricultural and commercial customers in the Black Hills Gas Distribution territory. Customers have about two weeks every year to make their third-party selections. In 2020, the selection period ran from April 10 to April 23. Customers who choose multi-year terms don’t have to select every year.

Customers not under multi-year contracts should always choose a supplier instead of assuming their current supplier and rates will roll over. The supplier will roll over—but it could be at higher rates.

The Nebraska Public Service Commission has a chart on its website showing the number of customers for each supplier and the supplier rates. The rates for customers who don’t choose are higher than the lowest-offered rate and may even be higher than the highest-offered rate. Take Constellation Energy. Its lowest offered rate in the Western Region is $0.494 per therm for a one-year term. Its highest-offered rate is $0.523. However, the rate is $0.735 for non-selection rollover customers.

Nevada

Natural Gas

Residential customers are not eligible for gas choice. Commercial and industrial consumers averaging more than 500 therms of gas daily may choose their supplier.

New Hampshire

Electric and Natural Gas

Only commercial and industrial consumers in the Granite State get to choose their natural gas provider. When it comes to electricity, both residential and non-residential consumers can choose—as long as they are in the Public Service Company of New Hampshire (PSNH), Liberty, Unitil Energy Systems (UES) and the New Hampshire Electric Cooperative (NHEC) territories.

The New Hampshire Public Utilities Commission maintains a website to help consumers shop for electric rates. The commission also offers lots of information on energy choice and what to ask suppliers. Community aggregation (community power) is also allowed in New Hampshire.

New Jersey

Electric and Natural Gas

If you’re a natural gas consumer in the Elizabethtown Gas, New Jersey Natural Gas, PSEG or South Jersey Gas territory, you can choose your supplier. Likewise, residential and non-residential electricity consumers can choose their supplier in the Atlantic City Electric, Jersey Central Power and Light, PSEG, and Rockland Electric territories.

Consumers may want to check out two websites: the New Jersey Board of Public Utilities and NJ Power Switch. NJ Power Switch is, unfortunately, of limited help for comparing rates and programs. Some of the links there are out of date or do not work.

Aggregation is common in New Jersey, with enrolled municipalities including Andover, Bayone, Linwood and Keyport.

New York

Electric and Natural Gas

New York runs the “Power to Choose” energy shopping website since many residential and non-residential customers in the state can pick their electric and natural gas suppliers. However, the state’s public service commission has a consumer advisory that pops up on the website (as of June 2020). The advisory cautions, “The Public Service Commission has been critical of certain Energy Services Companies, or ESCOs, particularly regarding prices. The Commission is considering whether the retail access market for energy commodity is working properly, or if it should be revised.”

The caution certainly does indicate one potential downside of deregulation—that consumers end up spending more money and do not fully understand their choices.

In the Central Hudson, ConEd, NYSEG, National Grid, Orange and Rockland and RG&E territories, electric choice is available. Community aggregation is available as well.

Natural gas options are available in the Central Hudson, ConEd, Corning Natural Gas, National Grid (Keyspan Energy Delivery NY), National Grid (Keyspan Energy Delivery LI), National Fuel Gas Distribution, NYSEG, National Grid (Niagara Mohawk), Orange and Rockland, RG&E, and St. Lawrence Natural Gas territories.

Ohio

Electric and Natural Gas

There’s plenty of energy choice in Ohio. The state explains, “Many Ohioans decide to shop in order to see savings off of their monthly energy bills, others value the certainty that comes from a fixed rate plan, and some switch to suppliers that will make a greater investment in renewable products.”

Electricity consumers in AEP Ohio, Dayton Power and Light, Duke Energy Ohio and FirstEnergy territories can choose their suppliers, as can natural gas consumers in the Columbia Gas, Dominion East Ohio, Duke Energy and Vectren Energy territories. Aggregators such as cities, townships and counties may also buy energy.

“Energy Choice Ohio” is a website run by the state public utilities commission to help consumers shop around. It’s straightforward to use, offering clear rate comparisons.

Oregon

Electric

Residential customers are not eligible for electric choice. It is available for commercial and industrial consumers using at least 30 kW per month in the Portland General Electric and Pacific Power utility territories.

Pennsylvania

Electric and Natural Gas

There’s lots of choice in Pennsylvania. Residential and non-residential customers in the Citizens’ Electric, Duquesne Light, Met-Ed, PECO Energy, Penelec, Penn Power, Pike County Light and Power, PPL Electric Utilities, UGI, Wellsboro Electric and West Penn Power can choose their electricity supplier.

Likewise, residential and non-residential consumers in the Columbia Gas, Peoples Natural Gas – Equitable Division, National Fuel Gas, PECO Gas, Peoples Natural Gas, Peoples TWP, Philadelphia Gas Works, UGI Utilities, UGI Central Penn Gas and UGI Penn Natural Gas territories can pick their natural gas provider.

The state’s “PAPowerSwitch” website helps consumers choose power suppliers, while “PAGasSwitch” does the same for natural gas. For both, you can consider factors such as cancellation fee, deposit required and monthly fee, along with term lengths and pricing (fixed, variable, unlimited). Additional considerations for electricity include net metering, renewable energy and solar.

Rhode Island

Electric and Natural Gas

Consumers in Rhode Island can choose their electric provider to be someone other than National Grid or Pascoag Utility District. Similarly, natural gas consumers can choose a supplier other than National Grid. Check out the “EmpowerRI” comparison website when you shop around.

The Rhode Island Public Utilities Commission maintains pages with information on competitive energy suppliers. For example, on the “Competitive Energy Suppliers - Q&A and Updates,” you can find links to recent relevant legislation, lists of competitive suppliers and the utility’s standard offer rates, among other things. Some of the data may be outdated, though, so beware. The National Grid Standard Offer data accessed in June 2020 had data from September 2016, nothing more recent. You can go to National Grid itself for more recent rates and an updated list of suppliers.

Tennessee

Natural Gas

Only commercial and industrial consumers get natural gas choice in Tennessee. They must be in the Piedmont service territory and have an average daily usage of more than 500 therms.

Texas

Electric and Natural Gas

Residential and non-residential customers in the AEP Central, AEP North, CenterPoint, Oncor, Sharyland, and Texas New Mexico Power territories can pick their electricity supplier. In all, these territories cover about 87% of Texas power consumers.

The Public Utility Commission of Texas runs the “Power to Choose” website so that Texas consumers can more easily shop around for suppliers. Type your ZIP code to see if you’re in a deregulated area and to survey the plans available. The number of results may be overwhelming (for example, Dallas ZIP code 75201 returns 67 plans). You can answer three questions on electricity usage, plan type and desired length of contract to narrow down the results but perhaps not by much. On the resulting comparison chart, you can whittle down results even further by choosing prepaid plans only (or eliminating them) or by considering various percentages of renewable energy up to 100%, among other things.

Plan types include fixed rate, variable (changing) and indexed (market rate). As the website explains, monthly (month-to-month) plans tend to be variable or indexed.

Natural gas choice is available too but only for commercial and industrial customers.

Wisconsin

Natural Gas

Only commercial and industrial consumers in the Wisconsin Public Service territory can choose their natural gas provider. Additionally, these consumers must use more than 5,000 therms of natural gas per year.

The state did explore electricity choice in the 1990s and concluded that there wouldn’t be enough choice to result in lower rates.

Virginia

Electricity and Natural Gas

Electric choice is sort of complicated in Virginia. For more than 20 years, the state’s two major utilities strenuously opposed deregulation. Even then, some loopholes opened up and are being used more and more.

For example, residential consumers have been able to choose their electricity supplier if they want 100% renewable energy sources, and their local utility does not offer the option. (Non-residential customers have had choice in the Appalachian Power and Dominion territories.)

Now, after a flurry of changed minds and new legislation, the utilities have become more open to residential aggregation and choice. Depending on how pilot programs go, more choice could be coming to Virginia in the next few years.

As for natural gas, choice is available in the Columbia Gas and WGL territories for residential and non-residential customers. The State Corporation Commission website has a list of competitive service providers and aggregators.

In April 2020, Virginia became the first southern state to set a goal of going carbon-free by 2045. Dominion must go carbon-free by 2045, while Appalachian Power has until 2050. Most coal plants in the state must shutter their doors by 2024.

Wyoming

Natural Gas

Residential gas choice is available only in the Black Hills territory. The program is called Choice Gas, and residential customers can choose plans lasting up to two years. Commercial and industrial customers can choose for up to three years. The pricing options include fixed rate per therm, market index rate, blended rate and fixed monthly bill.

References and Footnotes

- Electricity 101: Terms and Definitions. (n.d.). Resources for the Future. Retrieved June 5, 2020, from https://www.rff.org/publications/explainers/electricity-101/

- State-by-State Information. (n.d.). American Coalition of Competitive Energy Suppliers. Retrieved June 5, 2020, from http://competitiveenergy.org/consumer-tools/state-by-state-links/

- Brannon, I. (2020, March 1). A Mixed Record for Energy Deregulation. Forbes. Retrieved June 5, 2020, from https://www.forbes.com/sites/ikebrannon/2020/02/29/a-mixed-record-for-energy-deregulation/#3d5f5744742a

- Retail Electric Rates in Deregulated and Regulated States. PDF. (Updated 2017.) American Public Power Association. Retrieved June 5, 2020, from https://www.publicpower.org/system/files/documents/Retail-Electric-Rates-in-Deregulated-States-2017-Update%20%28003%29.pdf

- Electricity Residential Retail Choice Participation Has Declined Since 2014 Peak (2018, November 1). U.S. Energy Information Administration. Retrieved June 5, 2020, from https://www.eia.gov/todayinenergy/detail.php?id=37452

- Participation in Electricity Customer Choice Programs Has Remained Unchanged Since 2013. (2019, November 1). U.S. Energy Information Administration. Retrieved June 5, 2020, from https://www.eia.gov/todayinenergy/detail.php?id=41853

- Nikolewski, R. CCA 101: How Does Community Choice Aggregation Work? What You Need to Know. (2018, September 9). San Diego Union-Tribune. Retrieved June 5, 2020, from https://www.sandiegouniontribune.com/business/energy-green/sd-fi-cca-howtheywork-20180822-story.html

- MCE Customers Offered $1.3 Million in Cash Back for Generating Their Own Solar Energy in 2018-19. (2019, August 4). CalCCA. Retrieved June 5, 2020, from https://cal-cca.org/mce-customers-offered-1-3-million-in-cash-back-for-generating-their-own-solar-energy-in-2018-19/

- California Aggregator: The Quarterly Report of the California Community Choice Association. (2020, Spring). CalCCA. Retrieved June 5, 2020, from https://cal-cca.org/wp-content/uploads/2020/05/CalCCA-Spring-2020-Report-Web-Final-1.pdf

- CalCCA Homepage. (2020, June 5). CalCCA. Retrieved June 5, 2020, from https://cal-cca.org/

- CCA By State. (n.d.). Lean Energy. Retrieved June 5, 2020, from https://leanenergyus.org/cca-by-state/

- Massachusetts. (n.d.). Lean Energy. Retrieved June 5, 2020, from https://leanenergyus.org/cca-by-state/massachusetts/

- Shemkus, S. (2019, January 24). This Massachusetts City Hopes to Reinvest Energy Savings into More Energy Savings. Retrieved June 5, 2020, from https://energynews.us/2019/01/24/northeast/massachusetts-city-hopes-to-reinvest-energy-savings-into-more-energy-savings/

- O’Shaughnessy, E., et al. (2019). Community Choice Aggregation: Challenges, Opportunities, and Impacts on Renewable Energy Markets. Golden, CO: National Renewable Energy Laboratory. Retrieved June 5, 2020, from https://www.nrel.gov/docs/fy19osti/72195.pdf

- Natural Gas Explained: Natural Gas Customer Choice Programs. (2019, October). U.S. Energy Information Administration. Retrieved June 5, 2020, from https://www.eia.gov/energyexplained/natural-gas/customer-choice-programs.php

- Table 26. Number of customers eligible and participating in a customer choice program in the residential sector, 2018. PDF. (2018). US. Energy Information Administration. Retrieved June 5, 2020, from https://www.eia.gov/naturalgas/annual/pdf/table_026.pdf

- Litvak, A. (2020, February 20). Electric Confusion: Telemarketing Blitzes Leave Some Utility Customers Baffled, Regulators Determined. Pittsburgh Post-Gazette. Retrieved June 5, 2020, from https://www.post-gazette.com/business/powersource/2020/02/24/Telemarketing-electric-supplier-utility-customers-Pennsylvania-PUC-robo-calls-spoof-price/stories/202002190183

- Utility Scam Alert: National Grid. (n.d.). Retrieved June 5, 2020, from https://www.nationalgridus.com/Our-Company/Scam-Alert

- Dooley, D., and Barczak, S. (2019, April 18). Rewarding Failure: Taxpayers on Hook for $12 Billion Nuclear Boondoggle. Southern Alliance for Clean Energy. Retrieved June 5, 2020, from https://cleanenergy.org/blog/rewarding-failure-taxpayers-on-hook-for-12-billion-nuclear-boondoggle/

- Snitchler, T. (2020, January 23). When States Pick Expensive Policies under the Guise of ‘States’ Rights,’ Consumers Pay. Utility Dive. Retrieved June 5, 2020, from https://www.utilitydive.com/news/when-states-pick-expensive-policies-under-the-guise-of-states-rights-co/570978/