There is a seemingly endless supply of “pay-by-the-month” subscription services, from Netflix to meal-kit deliveries to clothing to online gaming. The most popular subscription services such as Amazon Prime and Netflix account for tens of millions of members in the U.S. alone. But what does overall subscription usage look like, and how are our habits changing?

We asked adults the week of March 29th – April 4th about their subscription services, including what they pay for, how much they actually use and what their future plans are. We covered streaming services, delivery subscriptions and many types of pay-by-the-month memberships. Our sample included a swath of American consumers across the continental US, in metro areas like Los Angeles and San Diego as well as more rural locations in Kentucky and Washington. We did not include internet service, traditional cable TV and phone subscriptions, nor did we include health insurance or certain types of memberships such as country clubs. See our full methodology.

Here’s a look at our key findings:

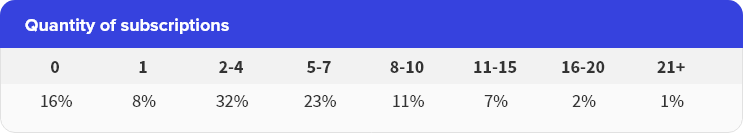

● Nearly all Americans are subscribing. Just under 16 percent of Americans have zero subscriptions to streaming services, delivery programs or memberships.

● The typical American subscribes to five or more services and spends $50+ per month.

● Power-Subscribers, which we’re calling the more than 20 million adults that make up the top 10 percent of subscribers, subscribe to 11 or more services, and spend $200 per month or more. The top one percent subscribe to 21 and spend $500 per month.

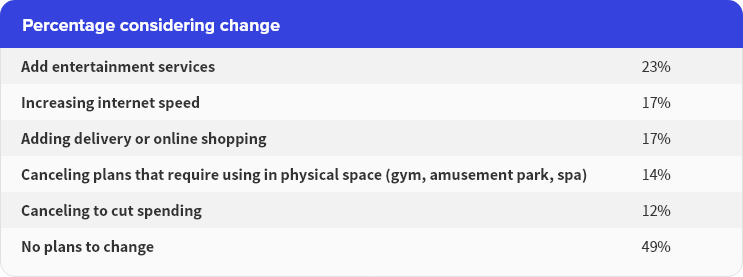

● Perhaps reflecting our current shelter-in-place culture, the most common potential subscription changes were adding entertainment streaming services (23.1 percent), boosting internet speeds (16.5 percent) and subscribing to delivery or online shopping services (16.5 percent).

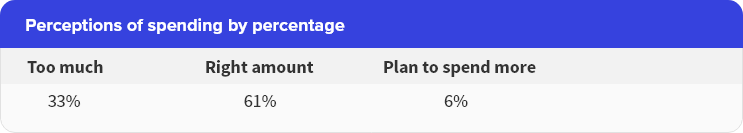

● Is the glass half-full or half-empty? While most Americans are satisfied with the amount they spend on subscriptions, about one-in-three say they’re already spending too much money.

Power Subscribers vs. Essentialists

The vast majority of survey participants have at least one subscription service. Only about 16 percent of people say they have no entertainment, delivery or membership plans. But while most Americans have at least one of these services, it’s clear there are huge differences in how fully some of us have embraced the subscription economy.

According to our analysis, the average subscription user spends just enough to cover the essential services, which include things like Netflix and Amazon Prime but exclude things like weight-loss services or amusement park passes. This group accounts for just over half of Americans, but our survey also identified a smaller group of power users, the top ten percent, who spend upwards of $200 per month on 11 or more subscription services that run the gamut from entertainment to delivery to personal care. (We’ll also cover the top one percent, who spend more than $500 per month on 21 or more subscriptions.)

So let’s first explore these two archetypes — the Power Subscriber and the Essentialist — and see what they have in common and where their needs and decision-making diverge. Is it a stretch to call Netflix or Amazon Prime essential? What may have sounded ridiculous in 2010 is very different.

Monthly spending on services

Power Subscriber: $200+

About 10 percent of Americans spend $200 per month on memberships. The top one percent spend more than $500 per month, up to a whopping $785 for the most lavish subscription spender.

Essentialist: $100 or less

Just under 53 percent of survey respondents spend between $1 and $100 per month, and nearly one in three — the largest single group of any spending range — pay less than $50.

Number of subscriptions

Power Subscriber: 11+

Ten percent of adults, representing 20 million Americans, subscribe to 11 or more services with the top one percent nearly doubling that with 21 (our most prolific respondent had 37 subscriptions.)

Essentialist: 1-6

More than half, 55 percent, of people we surveyed subscribe to between one and six services.

Engagement

Power Subscriber: All or most services

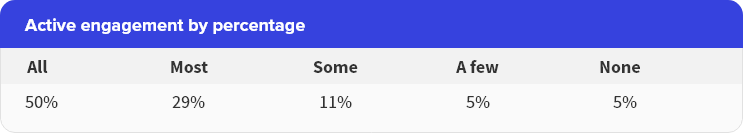

All of our Power Users said they engaged with either all or most of their subscription services and memberships.

Essentialist: All or most services

A smaller but still significant percentage of Essentialists say they use all (47 percent) or most (30 percent) of the services to which they subscribe.

Plans

Power Subscriber: Increasing speed

A majority of Power Users (60 percent) said they have no immediate plans to change their mix of subscription services despite the continued coronavirus crisis, but if they were to make changes, they all said they’d like to increase internet speed, while most (83 percent each) said they’d consider adding delivery or online shopping services and canceling plans that require visiting a physical location, such as gym or amusement park memberships.

Essentialist: No changes

As with Power Users, most Essentialists (57.8 percent) don’t have any plans to make changes to their subscription and membership service lineup, but if they were to consider changes, adding entertainment subscription services was the most popular option (16.5 percent).

Subscription, Delivery & Membership Services Landscape

Streaming and fast delivery services may be top of mind for Americans at the moment, but the ecosystem of subscription and membership services is vast and diverse, including gyms, spas, meal kits, personal care items, pet foods, news, media and more. Let’s take a deep dive into each of those areas.

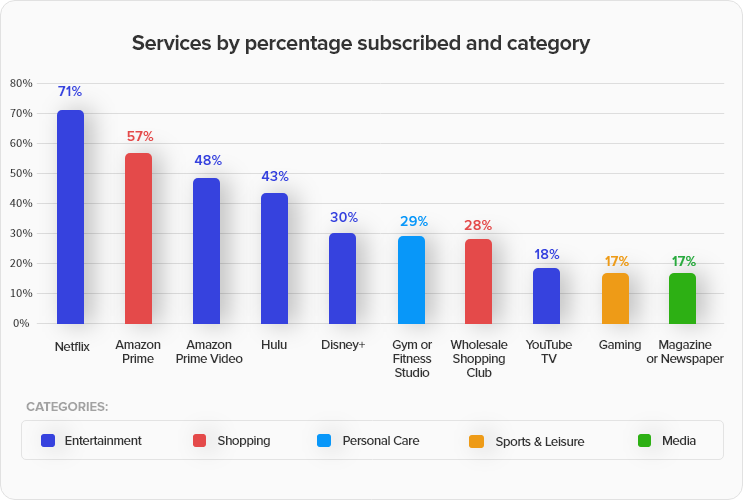

Top 10 overall

Entertainment streaming services account for about half of the top 10 subscription services, with Netflix the only subscription, delivery or membership service to crack the 70 percent adoption mark. Two shopping services (Amazon Prime and wholesale clubs) are among the top 10.

Few Americans can say they do not subscribe to any entertainment, delivery or membership services. As mentioned previously, about one in three have between two and four services, while about 23 percent subscribe to between five and seven.

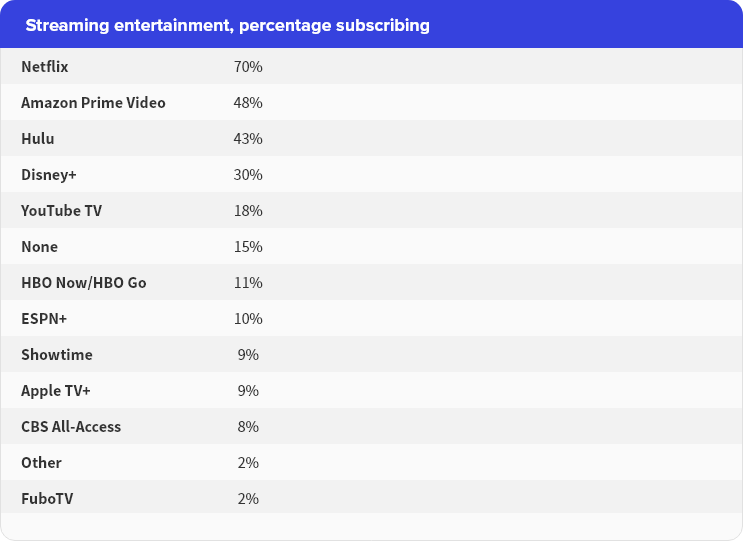

Streaming entertainment

Though it’s one of the newest additions, Disney+ is the fourth most-subscribed streaming service, according to our analysis, surpassing more established services, including HBO Now/HBO Go, Showtime and CBS All-Access.

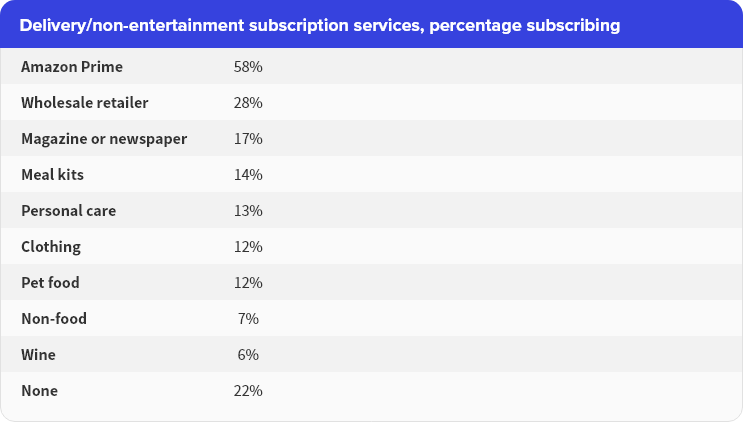

Delivery and other services

Shopping dominates when it comes to non-entertainment subscription services, though about one in five people don’t subscribe to any of these types of services.

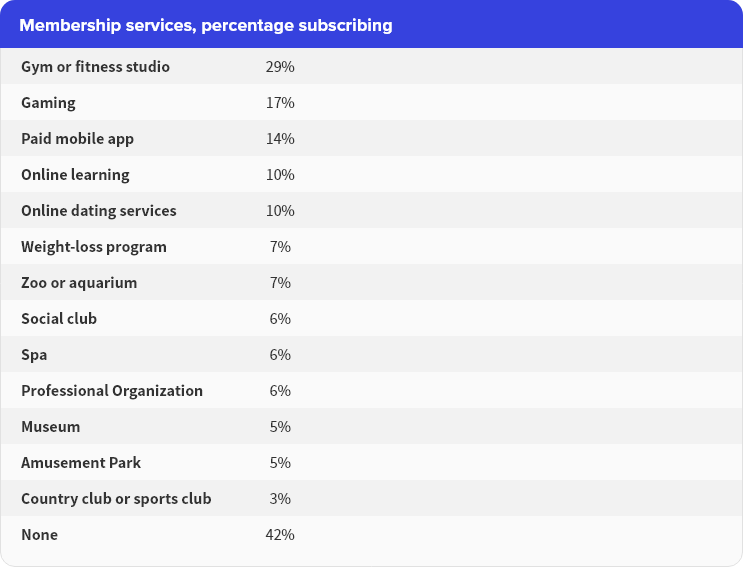

Membership services

When it comes to membership-based subscriptions, about two in five people say they don’t pay for any of this type of service, but the most commonly purchased is a gym or fitness studio membership.

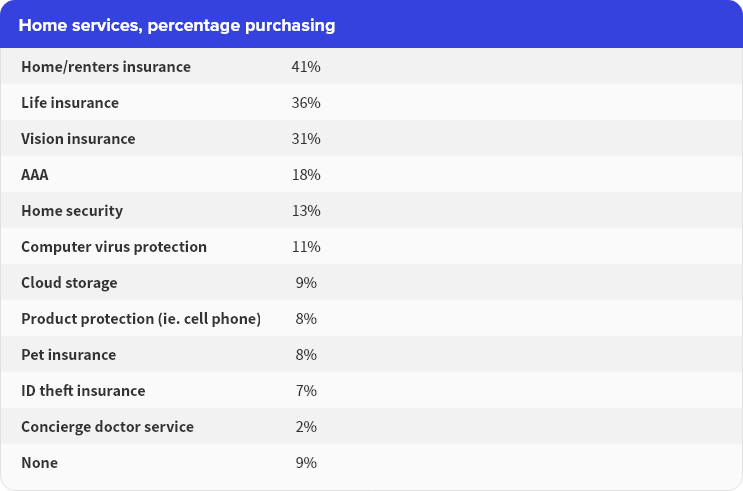

Home services

In addition to entertainment, delivery and membership subscription services, we also asked respondents about their use of home services like security and other services like AAA.

Comparisons

A few notable comparisons can be drawn between these home and personal services and optional subscription services. For example, a nearly identical percentage subscribe to clothing curation services (12 percent) and home security services (12 percent).

Spending & appetite for change

Few people seem to want to add services — only about six percent said they planned to spend more on subscription services, and one in three say they’re currently spending too much.

While many of our respondents don’t have active plans to make changes, adding more entertainment streaming services was the most commonly selected possible change, with boosting internet speed and adding delivery or online shopping services tied for second and third.

Service usage

Almost everyone we surveyed was heavily engaged with their subscription services — 79 percent said they used all or most of the services they paid for.

Conclusion

Our research indicates the appetite for subscription services can still grow, with the majority of Americans already purchasing multiple services and less than one-third indicating they can’t afford to add any services. While the full financial impact of the coronavirus has yet to hit, these are both clear indications that the subscription economy should have a healthy outlook.

About InMyArea and This Research

We asked more than 1000 adults about issues related to subscription and home services during the week of March 29th to April 4th. We covered a range of areas, including entertainment, memberships and delivery, as well as asking about home services like insurance, security and others. We excluded internet, phone and traditional cable/satellite TV services.